Friday, March 31, 2006

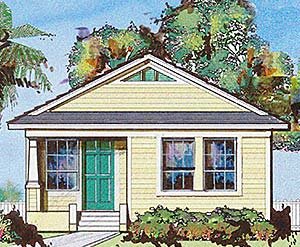

Nice looking House

Want to live in Carrollwood? My friends are selling their 4/2 house...If you like it send them an email or call 363-4525.

It's 4 A.M. Do You Know Where Your Realtor Is?

- New Yorkers may talk about living in a city that never sleeps, but most do the real estate dance by daylight. To set itself apart from the daytime-only crowd — and to squeeze in more appointments — the condominium sales office.....is open around the clock. In a city where all-night pharmacies or all-night copy shops can seem few and far between — not to mention all-night diners — an all-night real estate sales office is, to say the least, unusual.

Thursday, March 30, 2006

Condos to replace office park - Westshore

Increase in home value = more taxes

A 1997 change in the tax code excludes from the capital-gains taxes up to $250,000 of the sales proceeds for single homeowners and up to $500,000 for married couples, provided that the property was used as their primary residence for two of the last five years. Prior to the change, homeowners could defer or erase capital-gains taxes by immediately sinking their sales profits into a similarly priced or more expensive dwelling.

However, the changes made that year eliminated this provision, as well as another that gave retirees over the age of 55 a one-time exclusion of $125,000. Any profits above the $250,000 or $500,000 exclusions are taxed at the top capital-gains rate of 15 percent, though experts say most sellers are making enough from the sale to cover their tax bills.

The National Association of Realtors (NAR) reports a jump in the number of $500,000-plus home sales to over 827,000 single-family units in 2005, vs. 641,200 in 2004 and just 66,100 in 1996.

Because capital gains are added to their adjusted gross income, many home sellers no longer qualify for some deductions, personal exemptions and credits. If their incomes rise high enough as a result, they could also be hit with the alternative minimum tax.

Source: The Wall Street Journal (03/29/06)

Wednesday, March 29, 2006

Neighborhood Rejects Background Checks

http://www.tbo.com/news/metro/MGBIEAIIELE.html

Tuesday, March 28, 2006

Background Checks for Home Buyers

Proponents say the proposed amendment to the association's rules aims to keep sexual predators out of the 220-home subdivision. Critics say Longleaf's proposal raises concerns about privacy and fair-housing laws. If the proposed rule change passes, background checks will be conducted on buyers before they can close on a sale. The association could deny the sale if a check produces an unacceptable result. Similar restrictions are frequently part of sales in co-op buildings or condos but not typical for single family residences or townhomes.

There's nothing to prevent any homeowners association from requiring presale background checks. Anyone rejected because of a background check would have little room to sue, de Haan said. "A person who is applying for housing has no standing against the association," de Haan said. -TBO.com

Questions:

So if one person is not comfortable with an "applicants" background they'll put it to a vote?

How will this restriction affect home sales in the neighborhood?

What about a persons right to sell or the Fair Housing Act?

Alley Facts

Tampa has about 4,500 alleys, according to an August 05 study that also found:

- There are about 2,200 open alleys and almost 2,300 closed alleys.

- Of the city's 165 grids, each 1 square mile, 71 have alleys, including 59 with open alleys.

- East Tampa neighborhoods have the most open alleys, 400, followed by Seminole Heights with 376 and West Tampa with 267. New Tampa has no alleys.

- From 1980-83, the city's alley-vacating program closed more than 800 alleys, almost 70 percent of the nearly 1,200 alleys closed since 1980.

New way to "flip" real estate

These derivatives will enable investors to take a position on the direction of home prices either for the nation as a whole or for 10 major cities to start, including New York, Los Angeles and Chicago. Of the three major asset classes, the bond, the stock and the housing markets, only the housing market, which represents some $20 trillion in assets, cannot be speculated on easily, said Robert Shiller, the Yale economist and author of "Irrational Exuberance," the 2000 book that foresaw the bursting of the tech-stock bubble.

Who will use them?

Shiller sees these derivatives mostly as tools that large, institutional investors can use to reduce risks. Mortgage bankers, for example, could hedge against falling real estate markets that would increase their exposure to delinquencies and foreclosures.

So how would an ordinary consumer employ these tools?

By direct investment: Investors could buy futures in housing prices and profit if home prices continue to increase (if the investor goes long) or if they fall (if the investor goes short)

By locking in home equity: Home owners intending to sell within a year or two can go short in home price futures. If the price of their house drops, that can recapture the loss on the investment.

Case Shiller Weiss thinks home owners will eventually be able to buy home equity insurance that will protect against loss from falling home prices. Homeowners already have fire or storm insurance to protect them against losses, why not protection against losses from home price decreases?

Linking the price of a home to the index: A seller could peg the price of the home to the index by making it a multiple of the index for the city. A nice house in a prime neighborhood in Chicago, for example, might be listed at a constant 1,000 times the Chicago index value of 500, rather than simply at $500,000. Then as the index goes up and down, the home price changes as well. Both buyers and sellers would have confidence that the selling price was fair at the time of purchase.

Saturday, March 25, 2006

New condo proposed next to Floridian Hotel

Arbel is also working on the Floridian Hotel renovation. I believe his concept of customized units is nice but should increase the per unit price.

TBO - Published: Mar 23, 2006

TAMPA - A Miami-based developer wants to build a 37-story condo tower in downtown Tampa, with units customized to the buyers' desire.

Haim Einhorn, president of Arbel Inc., plans to build 250 residential units plus about 10,000 square feet of retail space, according to papers filed Wednesday with the city.

The project, bounded by Florida Avenue and Marion, Tyler and Cass streets, would be called Tampa City Lofts.

Prices would start in the low $200,000s, and open floor plans can be customized. Einhorn said he is targeting "average, work-force people."

The tower, adjacent to the Floridan Hotel, would feature a five-level parking garage, with a pool deck on the sixth floor.

The project is the latest designed to bring residents downtown. About 1,650 units are under construction or planned for the North Franklin Street area, according to the Tampa Downtown Partnership.

The project, which would be 459 feet tall, needs city council approval because the height limit in the area is 120 feet.

A tentative public hearing is scheduled for 6 p.m. Aug. 17.

If approval is granted, groundbreaking is expected next year.

Friday, March 24, 2006

Tampa City Council Supports Maas Bros.

Tampa City Council gave final approval Thursday to a plan to turn the former Maas Bros. building into a condominium tower. Wood Partners plans to turn the Maas Bros. block on Franklin Street into a 32-story, 503-unit condo tower. The building will rise 460 feet.

CONTACT: David Thompson of Wood Partners, 813-258-6585

Wood Partners is under contract to purchase the Maas Brothers block from its current owner, 610 Franklin, LLC. (aka Patel)

Six Ten Franklin

Tuesday, March 21, 2006

Home Inspections Prior to Selling Home?

Proven Way to Sell Homes Quickly for the Most Money

TAMPA, Fla., March 21 /PRNewswire/ -- Homeowners are protecting their real estate investments by conducting home inspections prior to selling their homes. By identifying hidden problem spots, sellers are able to fix problems in order to sell homes faster and for more money. Conducting pre-list home inspections and repairing problems before the home goes on the market can speed home sales by as much as 30 percent.

Pillar to Post Home inspections are no longer a mom and pop operation

SkyPoint earns new multi-million-dollar investor

Tampa Bay Business Journal - 5:52 PM EST Tuesday

With several of its 32 floors already coming out of the ground, downtown Tampa's SkyPoint residential tower is getting some fresh cash from an Atlanta investment firm.

Jamestown, a real estate investment and management company, has committed $10.5 million total to both SkyPoint and a similar condo tower project under construction by Novare Group in Charlotte, N.C. Jamestown executives are calling it the first "opportunistic deal" they have made in two years, expanding its base outside its traditional New York, Washington, D.C., and Boston markets.

With its investment in SkyPoint and Avenue, a 36-story, 386-unit tower in Charlotte, Jamestown has effectively taken out a portion of Novare's cash in the deals.

In return, Jamestown will receive a preferred return on its investment and a portion of the excess profits, a release said.

Jamestown executives are looking at developing a long-term relationship with Novare, and looking at other projects under development in Atlanta and Nashville, they said.

Both the Tampa and Charlotte projects are more than 80 percent sold, and both are expected to open in Spring 2007.

SkyPoint, on North Ashley Drive, will be comprised of 380 units and 10,500 square feet of retail.

Hillsborough Adds 133,204 Residents

TAMPA - Hillsborough County continues to be one of the nation's biggest producers of new residents; a harvest cropping up at new subdivisions, office plazas and on increasingly crowded highways.

New population estimates released today by the U.S. Census Bureau show that the county gained 133,204 residents since April 2000, the 15th-largest increase in the nation. This increase, to an estimated 1,132,152 Hillsborough residents, is reflective of past and future growth that one estimate says will last through 2030.

Economists watching Florida and the Tampa Bay area's booming population wonder how smoothly jobs, housing and services grow, blend and develop as Florida grows.

These population predictions translate into positives in the form of job growth, new residential and commercial construction and the demand for businesses to provide goods and services to new residents.

Those same transplants, however, place demands on Hillsborough's infrastructure, health care system and the cost of housing. That includes the rush hour impact of commuters moving to booming counties such as Pasco, Hernando and Polk.

Growth will work best if Florida focuses less on construction on vacant land and looks more at redeveloping existing neighborhoods and business locations, said Jim Hosler, team leader of research and economic development for the Hillsborough County City-County Planning Commission.

Real estate sales trends reflect some impact of the area's growth. Recent slowdowns in Florida's active real estate market is likely a result of a drop in the number of speculative buyers, Reaser said. Investors buying so much real estate in the past created a shortage in inventory, and forced home prices up, she said.

Brad Monroe, president of the Greater Tampa Association of Realtors, said Hillsborough County is returning to a more traditional sales pace, with an inventory of two to three months' worth of available real estate.

Monday, March 20, 2006

Condo conversions thrown into reverse

BOYNTON BEACH -- A conversion reversion at a South Florida apartment complex could serve as an indicator to the rest of the state that the condominium craze has reached its peak.

The Gateway Club at Orchid Lakes, a 319-unit apartment community in Boynton Beach that announced a conversion to condominiums late last year, has switched back to a rental community

Sunday, March 19, 2006

InTown + West Tampa

That was then.... By Times StaffPublished May 17, 2005

TAMPA - The West Tampa Community Development Corporation and InTown Properties have entered into a development agreement to build single-family homes in West Tampa.

InTown Properties is a development company created by former county commissioner Ed Turanchik.

This is now.... Weekly Planet March 15, 2006

The mural is well-known to everyone in West Tampa, even if it is mostly obscured by trees that have grown up in front of it at Main Street and Howard Avenue. It reads, "It's Time For West Tampa." The most recent attempt to prove the mural right can be found on Albany Street a few blocks north of the interstate, one of the extra-wide residential streets that criss-cross West Tampa. Construction workers are putting the last touches on three new homes that could change the neighborhood forever. A carpenter nails a vinyl soffit into a porch ceiling that looks just like the wood slats found in homes 100 years older.

The three homes sit on lots no wider than 33 feet. One bungalow is just 18 feet wide, in the traditional "shotgun" configuration -- meaning that a load of buckshot fired through the front door could fly out the back door unimpeded. It is an architecture that is familiar to Tampa... Familiar, that is, at the turn of the 19th century.

They are the brainchild of former Hillsborough County Commissioner, unsuccessful Olympics bidder, failed Civitas partner and all-around dreamer Ed Turanchik.

He has plans to build more than 75 new homes -- historically accurate and affordable -- in West Tampa.

Nowhere else in Tampa Bay, and perhaps in Florida, is there a better chance to create a modern urban neighborhood than here in West Tampa. To create a highly dense, affordable, working-class, transit-ready city within a city. To create a model for how this state can turn its growth inward to its urban cores rather than sprawling across virgin scrub-palmetto fields and former citrus groves.

His biggest obstacle was Tampa's antiquated zoning laws, which were designed for suburban construction, not urban challenges. He wanted the city to allow him to recreate the neighborhood exactly as it was in 1931. Just a week before his project launches, Turanchik unrolls a plat map from that year for a visitor to his office, showing how densely packed the neighborhood was, as much as 13 units per acre -- the same density as exists on Harbour Island in downtown Tampa. He convinced city officials that the historic patterns of growth were better than the current suburban-oriented rules.

Rules:

Must get construction loan and cannot deviate from pre-designed plans

Must live in home for 3 years- Homestead

No rentals

One house to a customer

Bungalows (pic above) are income restricted (43k household)

Madatory monthly lawn service $50.

Questions:

Will they pay the interest only payment for the construction loan if the preferred lenders are not used (GTE and Suncoast)

Will comps (appraisals) be available in an area where homes are much less then sales price (239k)

Regulatory:

Developers and urban visionaries have a remarkable amount of regulatory hoops they have to jump through to build something new or start a business. The city allows for the opportunity for change in West Tampa, on one hand, while putting numerous obstacles in its path -- for instance, giving unusually strong oversight authority to neighborhood residents through what is called an "overlay" district that calls for tough design and construction standards. An informal Overlay Committee of those residents meets to discuss new projects, and its clout with Tampa City Council is strong, if not specifically grounded in law.

Friday, March 17, 2006

The Kress - round II

Last week, the City Council voted to designate as historic landmarks the facades of the Newberry and Woolworth buildings on N Franklin Street, despite objections from the owners of the buildings. The council also ignored a request for compromise from Mayor Pam Iorio, who is eager to seeN Franklin transform into a bustling residential neighborhood. She suggested that the city use zoning documents and monitoring by the city staff to protect the buildings.

But Thursday council members learned the legal description in the ordinance they approved encompassed more property than they had thought.

"The ordinance they adopted is out there. It's valid, it's applicable," but it does not properly identify the land in question, said City Attorney David Smith. "The best way to fix it is to start the process all over again."

That means sending the designation request back to the Historic Preservation Commission for approval, then the City Council, then the Hillsborough County City-County Planning Commission, then back to the City Council for two public hearings, a process that can take months, Smith said. -SPTimes 3/17

Conversion numbers

Apartments converted into condominiums in Tampa Bay area since 2001.

HILLSBOROUGH: 50 properties, 14,996 units, 15.3 percent of apartments countywide as of 2001.

PINELLAS: 47 properties, 11,000 units, 21.5 percent of apartments countywide as of 2001

Source: Bay Area Apartment Association

Wednesday, March 15, 2006

Bay to Bay activity

The previous post reminded me of a project that Tampa City Council recently voted down. Developer South East Capital Partners tried to get zoning approved for The View. A 26 story bldg next to the cross town and adjacent to Patches (who by the way serves and awesome omelette). It was voted down primarily for it's height and because council believed it would set a precedent for other developers to build "inland". The building wouldn't be on Bayshore and maybe council believed the next highrise would be on McDill!

More Developers:

Crescent Resources - developed One Bayshore (across from Publix) and have plans for 4 more towers in the vicinity. The latest is simply "C" c-itall

Byrd - Would like to develop BLU adjacent to the Channelside Complex and at the tip of Harbor Island. The project would include 2 towers, office space and a SweetBay (formerly Kash n' Karry) BLU

Apts on Bayshore sold - Crescent

Purchased by Citivest, developer of The Stovall on Bayshore. Citivest would like to re-zone the parcel to allow for more height. In turn they would allocate space for a small park.

Complex sold, will stay apartments

Bay Oaks Apartments, a 176-unit rental complex on South Tampa's Bayshore Boulevard, has a new owner -- and it is not converting the property to condominiums.

The 32-year-old complex was purchased for $27 million, or $153,409 per unit, by Crescent Resources LLC of Charlotte, N.C., from Carter-Haston of Nashville, Tenn., said officials with Cushman & Wakefield, which brokered the deal.

Despite the recent rash of apartment complex purchases being converted into condominiums, Bay Oaks will retain its name and its rental status. Rents on the property average about $708 per month, compared to Tampa's average rental price of $676 monthly, according to the Apartment Ratings Web site.

Crescent is active in the Tampa Bay area, planning two additional office buildings on Boy Scout Boulevard across from International Plaza in Tampa. Crescent, a subsidiary of Duke Energy Corp. in Charlotte, owns and manages 1 million square feet of offices in the West Shore business district, plus 400,000 square feet at Hidden River.

1,500 Condos coming to New Tampa

Plan Calls For 1,500 Condos Along Bruce B. Downs - TBO

A Tampa shopping center developer has been holding on to 644 acres along Bruce B. Downs Boulevard for more than a decade.

Now the Giunta Group wants to build 1,500 condos plus 85,000 square feet of office and retail space north of the Lake Forest subdivision.

The group has applied to rezone the agricultural tract for a planned development. Most of the site, 565 acres, is protected wetlands, so the development would have to be on the fringes and along Bruce B. Downs Boulevard.

The project would represent the tallest buildings in New Tampa's Bruce B. Downs corridor. To maximize density, all but 135 of the condominium units would be built in five-story buildings atop parking garages. The remaining units, those closest to North Oaks and Lake Forest, would be three-story buildings atop garages.